The smart Trick of Ach Payment Solution That Nobody is Talking About

EFT payments (EFT stands for electronic funds transfer) can be made use of reciprocally with ACH repayments. They both explain the same payments mechanism.:-: Pros Cost: ACH repayments have a tendency to be more affordable than cable transfers Rate: faster considering that they do not make use of a "set" process Disadvantages Rate: ACH settlements can take a number of days to process Price: relatively expensive resource: There are 2 types of ACH settlements.

ACH credit purchases allow you "press" money to different banks (either your very own or to others). They make use of ACH credit transactions to press money to their employees' financial institution accounts at assigned pay durations.

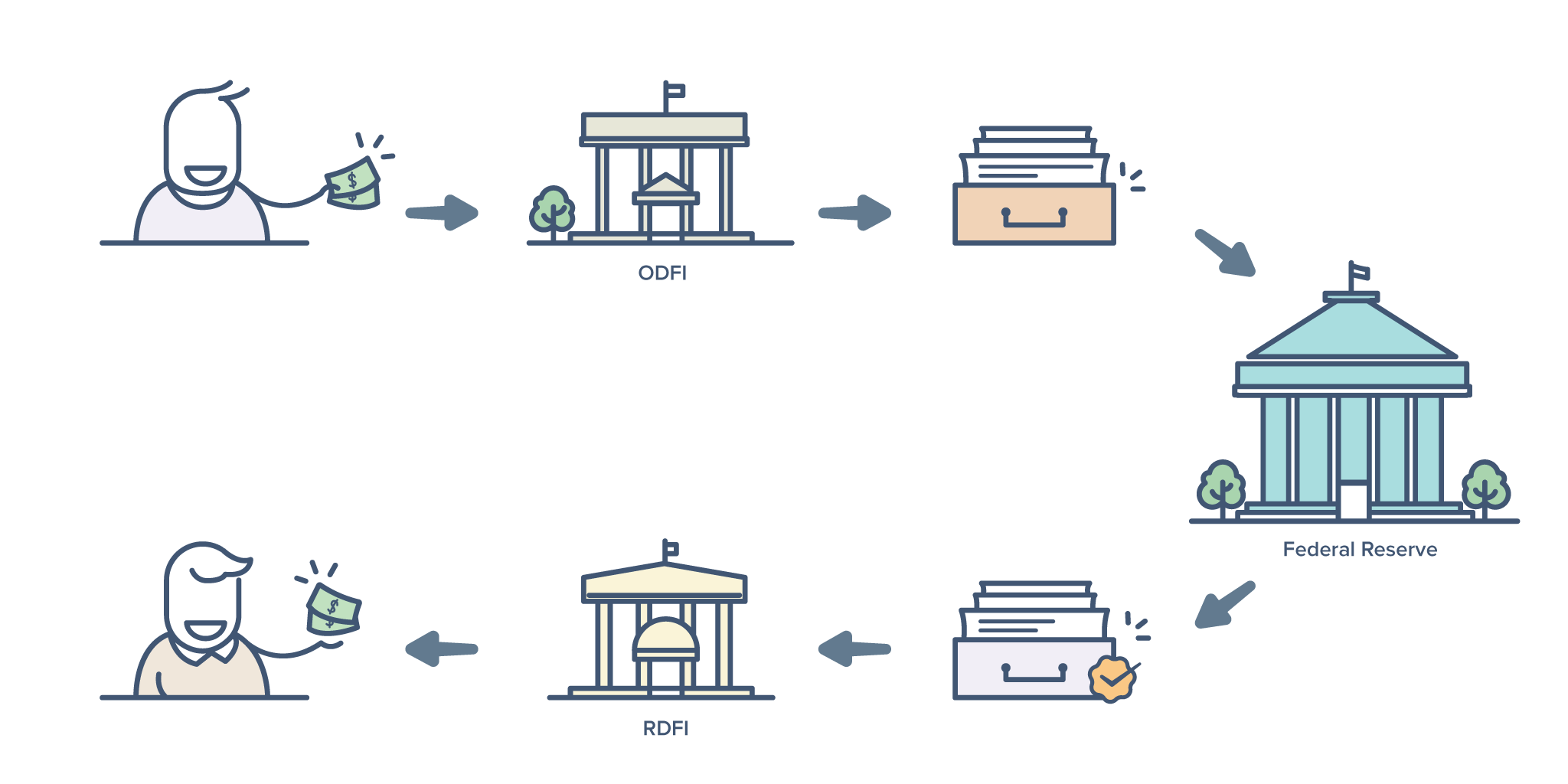

Consumers that pay a service (state, their insurance coverage company or mortgage lending institution) at certain periods might select to register for reoccuring settlements. That provides the company the ability to start ACH debit deals at each payment cycle, drawing the quantity owed straight from the customer's account. Other than the Automated Cleaning Home network (which links all the banks in the United States), there are three various other gamers associated with ACH repayments: The Originating Depository Financial Institution (ODFI) is the financial institution that starts the deal.

The Buzz on Ach Payment Solution

The National Automated Clearing House Organization (NACHA) is the nonpartisan governmental entity accountable for looking after as well as regulating the ACH network (ach payment solution). Allow's take your automated monthly phone expense repayments as an instance. When you sign up for autopay with your phone company, you give your bank account information (directing and also account number) and sign a reoccuring repayment authorization.

Both financial institutions then interact to make sure that there suffice funds in your savings account to refine the purchase. If you have sufficient funds, the purchase is processed and the cash is transmitted click for more info to your telephone company's checking account. ACH settlements normally take several business days (the days on which financial institutions are open) to experience.

, financial institutions can select to have ACH credit scores refined and also delivered either within a service day or in one to 2 days. ACH debit deals, on the other hand, have to be refined by the following business day.

The changes (which are taking place in phases) will make feasible prevalent usage of same-day ACH payments by March 2018. ACH repayments are commonly a lot more budget friendly for organizations to procedure than credit report cards.

The Best Strategy To Use For Ach Payment Solution

Some ACH cpus bill a flat price, which commonly ranges from $0. 5 percent to one percent per deal. Suppliers might additionally bill an additional month-to-month fee for ACH settlements, which can vary.

These deny codes are essential for offering the right information to your clients as to why their settlement really did not experience (ach payment solution). Right click over here here are the four most common decline codes: This suggests the consumer didn't have sufficient money in their account to cover the amount of the debit entrance. When you get this code, you're possibly mosting likely to have to rerun the deal after the customer transfers more cash into their account or gives a various payment method.

It's most likely they forgot to notify you of the adjustment. They need to provide you with a brand-new checking account to process the transaction. This code is activated when some combination of the information offered (the account number as well as name on the account) doesn't match the financial institution's documents or a missing account number was entered.

In this case, the customer requires to give their bank with your ACH Pioneer ID to allow ACH withdrawals by your business. Turned down ACH Learn More Here payments can land your business a charge charge.

9 Easy Facts About Ach Payment Solution Explained

To avoid the headache of disentangling ACH rejects, it may be worth only accepting ACH repayments from trusted customers.

That indicates you can't send or get bank details via unencrypted email or unconfident web forms. See to it that if you utilize a 3rd party for ACH payment handling, it has carried out systems with modern security approaches. Under the NACHA guidelines, begetters of ACH payments should likewise take "readily reasonable" steps to make certain the credibility of client identity and transmitting numbers, and also to recognize feasible fraudulent task.

Comments on “What Does Ach Payment Solution Mean?”